Introduction

The industrial landscape is shifting fast, and private equity-backed firms are leading much of that change. Financiers are reshaping industries, driving modernization through revamped supply chains, retooled factories, and reimagined global energy networks. Capital drives the growth in manufacturing and energy logistics, as well as redefines the concept of efficiency and sustainability. This wave of change is reshaping industrial progress, transforming both how it is financed and how it is presented.

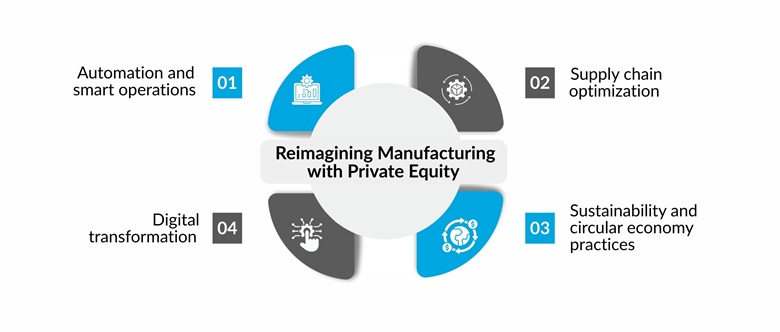

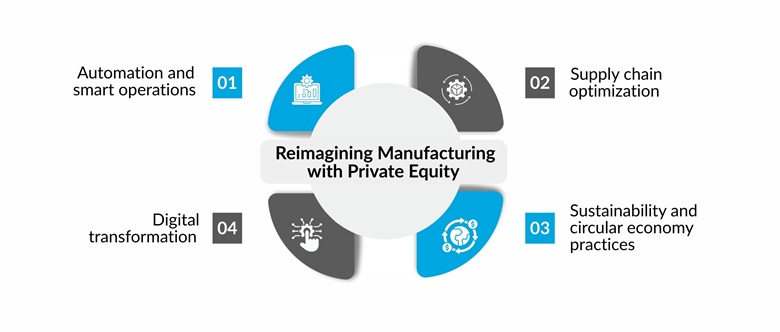

Manufacturing Reimagined Under Private Equity Ownership

When a manufacturing organization is backed with private equity, it is more than just finance. These companies are concerned with operational excellence, innovation, and the transformation of supply chains.

Key areas of focus include:

-

Automation and smart operations: Equipment modernization and real-time monitoring minimize downtime and increase throughput without being rigid.

-

Supply chain optimization: Low-cost sourcing is replaced by resilient, regionally diversified networks, reducing the risk of disruption and accelerating reaction to changes in the market.

-

Digital transformation: Data in the decision with production planning, quality control, and predictive maintenance accelerates the innovation process and narrows the margins.

-

Sustainability and circular economy practices: In more plants owned by private equity, sustainable processes,

energy-saving, and waste-reduction activities are integrated.

Concerning the value-creation perspective, statistics indicate that a manufacturing company supported by a

private-equity firm has by far a higher possibility to employ multiple of these levers simultaneously rather than reducing costs. As per McKinsey’s 2025 report on Global Private Markets, 30 percent of the portfolio companies involved in a buyout had been the subject of a liquidity event in the recent past with a greater emphasis on operational change.

The Shift in Energy Logistics: From Assets to Intelligence

In the dynamic logistics environment, the transport of energy is not merely bulk transportation. The current trends in the digital, smart infrastructure are driven by the profound support of companies under the protection of private equity. The international energy logistics market was approximately USD 477.2 billion in 2025, and it is likely to rise by a large margin.

Key elements of this shift:

-

Data-driven operations: Modern logistics do not use manual routing and fixed schedules. Instead rely on real-time analytics, helping to make dynamic decisions using demand, weather, and deviations.

-

Asset-light vs. asset-heavy: A significant number of companies abandon huge fleets and fixed-line terminals and transition to flexible systems that revolve around software platforms, dynamic networks, and third-party transport management of all hardware.

-

Digital connectivity and visibility: End-to-end tracking, predictive maintenance, digital twins, and IoT sensors provide complete visibility throughout the chain, enabling earlier intervention, reduction of delay, and efficient use of assets.

-

Renewables and new energy vectors: With the growth of renewable infrastructure, logistics should change too. This includes transporting large wind turbines and batteries and supporting hydrogen supply chains. The intelligence layer informs about the most appropriate allocation of the limited transport resources and connectivity of new energy streams.

Operational Playbooks: How Private Equity-Backed Companies Create Value

Private equity-backed firms in the industrial sector are redefining value creation, extending far beyond conventional financial engineering. Recent studies indicate that 33 percent of deal teams mention operational improvement as the most valuable lever of value creation, almost twice as many as other most frequently used levers.

The major implementation plans are:

-

Lean operations and process standardization: These companies map operations, eliminate unnecessary steps in production or supply chains, and employ perpetual improvement methods to help minimize waste and increase throughput.

-

Procurement consolidation and strategic sourcing: They balance the volume across units, consolidate the supplier contracts, and promote the preferred vendor programs to obtain a superior cost structure and reduce the risk of the supply chain.

-

Data-driven performance monitoring: Dashboards show cycle time, yield, maintenance downtime, and service levels in real time. This provides a quick way to take corrective measures and ensure operations match financial objectives.

-

Integration of ESG and talent strategies: The value creation is not only a question of cost anymore; it has also expanded to encompass workforce upskilling, safety, energy saving, and sustainable logistics in the business model.

Capital Meets Carbon: Driving Sustainability and Energy Efficiency

For industrial enterprises partially or wholly owned by the private sector, sustainability drives growth rather than simply meeting compliance targets. As the investors focus on long-term resilience, these companies are transforming the manufacturing and energy logistics, delivering quantifiable benefits to the environment and operations. The 2025 Global Private Equity ESG Outlook by PwC states that 78% of industrial-based funds today incorporate carbon-reduction metrics as part of their investment process.

Key operational levers:

-

Renewable energy integration: On-site renewable energy installations (e.g., solar microgrids and wind turbines) are being deployed and financed by many companies with a private-equity stake. These will reduce operating expenses and increase energy security when the markets are volatile.

-

Waste-to-Energy and Circular Operations: Production facilities are converting waste products into energy-saving forms, enhancing efficiency and minimizing landfills. It is a model that encourages regulatory compliance and enhances the brand positioning of sustainability-conscious clients.

-

Carbon tracking and data-driven efficiency: Carbon-accounting software enables the company to measure and control carbon emissions, both in production and logistics. Digital monitoring offers insights that are real-time and whip in reporting sustainability.

-

Sustainable logistics networks: Logistics departments are embracing low-emission flotations, streamlined routes, and green supply chains. These measures reduce the use of fuel, enhance the reliability of delivery, and establish customer confidence.

Cross-Sector Synergies: When Manufacturing Meets Energy Logistics

Manufacturing and energy logistical lines are becoming indistinct, with industrial processes becoming intertwined ecosystems. The companies that are driving this change are those supported by private equity to balance production efficiency with energy resilience to open new sources of value.

Modeen manufacturing facilities are not merely consumers of energy; many of them are becoming involved in the management of energy. These facilities will be capable of maximizing energy consumption, reducing downtime, and enhancing the predictability of costs by incorporating renewable generation technologies and high-tech storage technologies. This has changed energy logistics to be a strategic asset as opposed to a background role.

The major areas where these synergies are taking shape include:

-

Decentralized Energy Systems: Manufacturing facilities are also converting to microgrids and local power systems that enhance their continuity of operation and decrease their reliance on external grids. This strategy makes sure that the production process is stable even when there are energy disruptions and meets the output goals.

-

Data-Driven Efficiency: The real-time energy analytics will enable the companies to optimize production schedules according to the availability of energy and reduce waste. The knowledge of these systems is also applicable to predictive maintenance that minimizes failures of equipment and downtime.

-

Sustainable Supply Chains: The logistical networks of energy are being reorganized in order to address the

low-carbon transportation and sourcing of materials. This turnaround assists the companies in complying with the stricter regulatory criteria, as well as attracting partners and clients who are interested in environmental friendliness.

Conclusion

Logistics firms financed by private equity are transforming the industry's operations and growth. These companies are creating smarter, cleaner, and more robust industrial systems by matching and integrating technology with sustainability and operational efficiency. Their strategy extends further than financial performance, with long-term value generation by innovation, agility, and environmental responsibility, a clear break in the way modern industry thinks of progress.